cap and trade vs carbon tax canada

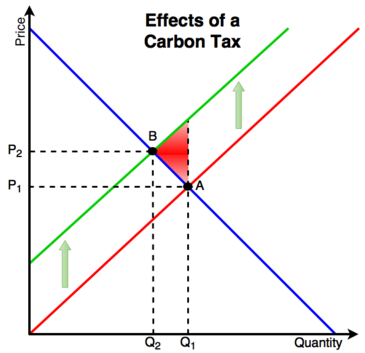

By Brian Schimmoller Contributing Editor. The price of the carbon is determined by assessing the cost of damage associated with each unit of pollution and the cost of controlling that pollution Grantham.

Cap-and-trade has one key environmental advantage over a carbon tax.

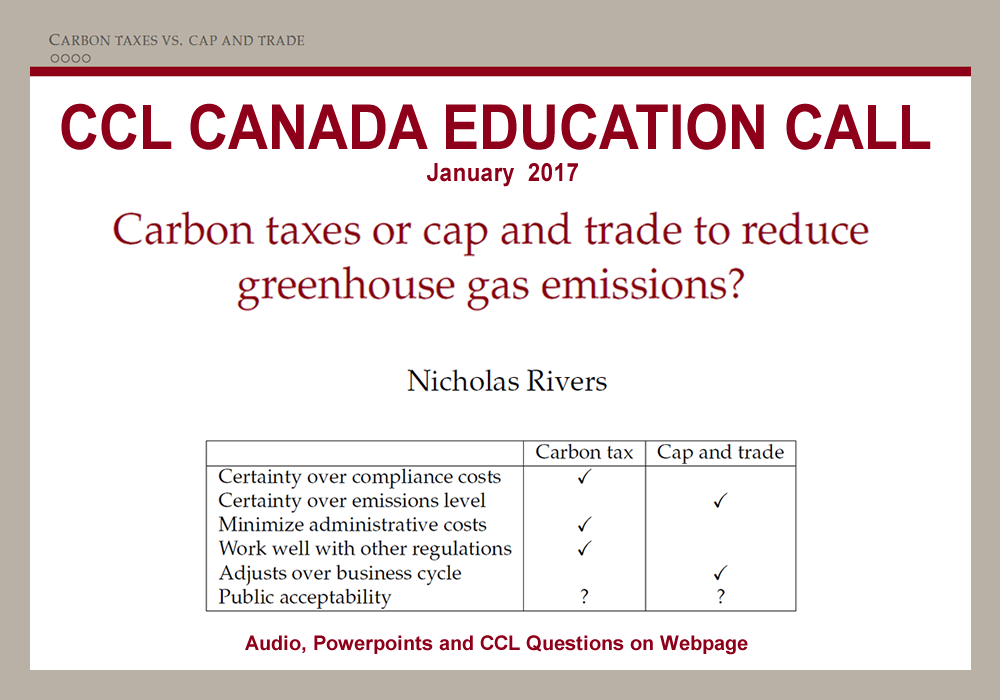

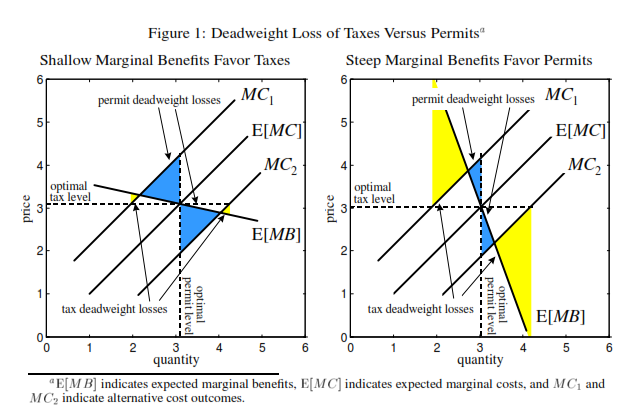

. Provincial carbon tax and OBPS. The basic economic question between carbon tax and cap-and-trade is about whether you should use a tax to set the price of carbon and let the quantity emitted adjust or. However some differences exist.

Additionally our experiment showed that emissions were 117 percent lower under the cap-and-trade scenario. With a tax you get certainty about prices but uncertainty about emission reductions. Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon.

A proper carbon tax will deter fossil fuels and. Cap and trade and a carbon tax are two distinct policies aimed at reducing greenhouse gas GHG emissions. While Carbon taxes are way easier to implement and are less open to political challenges the Cap and Trade systems are more likely to provide appropriate pricing.

Carbon Tax vs. Theory and practice Robert N. There is less agreement however among economists and others in the policy community regarding the choice of specific carbon-pricing policy instrument with some.

This was partly due to lower production volume overall but the. You can tweak a tax to shift the balance. It provides more certainty about the amount of emissions re See more.

Carbon taxes vs. Provincial fuel charge federal OBPS. With a cap you get the inverse.

Cap and Trade vs. Both cap-and-trade programs and carbon taxes can work well as long as they are designed to provide a strong economic signal to switch to cleaner energy. Each approach has its vocal supporters.

Not quite yet I prefer a carbon tax over cap-and-trade but cap-and-trade over nothing Appalachian State economics professor John Whitehead wrote on the Environmental. A Carbon Tax vs Cap-and-Trade. But based on the previous analysis for Canada the method that can impact carbon dioxide emissions the most is the carbon tax system.

Future energy historians will likely point to November 7 2006. The Canadian Chamber of Commerce has released an economic paper titled A Carbon Tax vs Cap-and-Trade analysing the two systems of reducing the.

Carbon Tax Pros And Cons Economics Help

Cap And Trade Vs Taxes Center For Climate And Energy Solutionscenter For Climate And Energy Solutions

How Cap And Trade Works Environmental Defense Fund

Carbon Tax Vs Emissions Trading Energy Education

Ccl Canada Education Carbon Taxes Or Cap And Trade To Reduce Greenhouse Gas Emissions With Dr Nicholas Rivers Citizens Climate Lobby Canada

/cdn.vox-cdn.com/uploads/chorus_asset/file/8689949/sightline_carbon_pricing_map.png)

40 Countries Are Making Polluters Pay For Carbon Pollution Guess Who S Not Vox

Kathleen Wynne S Attack On The Ontario Pc Carbon Tax Plan Misleads Voters Macleans Ca

Difference Between Carbon Tax And Cap And Trade Youtube

/cloudfront-us-east-1.images.arcpublishing.com/tgam/EMEVYNTTNFNRHC53CAHNYV2MNQ.jpg)

Canada S Carbon Pricing How Much Is It And How Does It Work What You Need To Know The Globe And Mail

Kathleen Wynne S Attack On The Ontario Pc Carbon Tax Plan Misleads Voters Macleans Ca

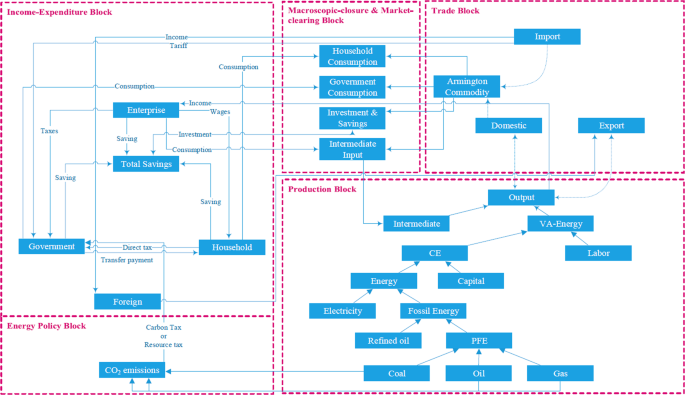

Supply Control Vs Demand Control Why Is Resource Tax More Effective Than Carbon Tax In Reducing Emissions Humanities And Social Sciences Communications

The Green New Deal And The Future Of Carbon Pricing Fischer 2021 Journal Of Policy Analysis And Management Wiley Online Library

Laser Talk Bc Carbon Tax Vs Carbon Fee And Dividend Citizens Climate Lobby Canada

Here S Why B C S Carbon Tax Is Super Popular And Effective Grist

Carbon Tax Or Cap And Trade David Suzuki Foundation

A Global Carbon Tax Or Cap And Trade Part 1 The Economic Arguments Center For Global Development Ideas To Action